Public Procurement Act amendment raises corruption concerns

Concerns have been raised about the possible looting of state resources after President Emmerson Mnangagwa used his Presidential Powers to amend the Public Procurement and Disposal of Public Assets Act with a recently gazetted Statutory Instrument 156 of 2023.

The purpose of the Public Procurement and Disposal of Public Assets Act (Chapter 22:23) is to encourage transparency in the public tender process by making sure that procurement and disposal is done in a transparent, fair, honest, cost-effective and competitive manner.

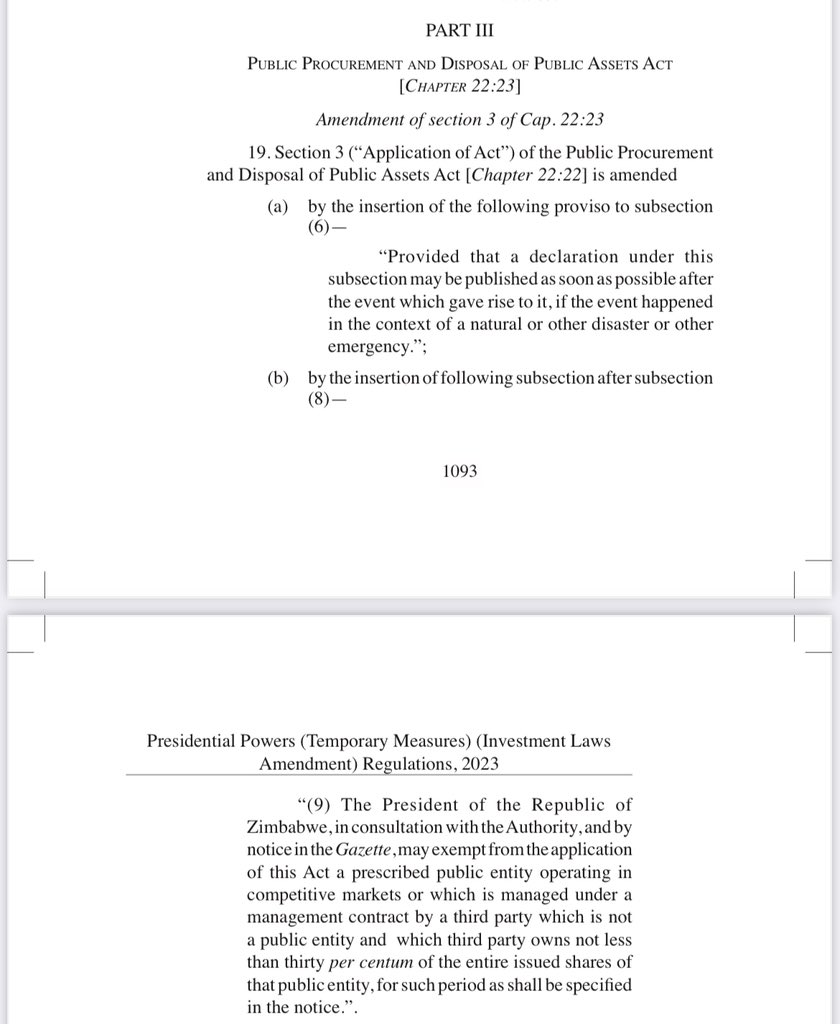

However, the following provision has been added Section 3 of the Public Procurement and Disposal of Public Assets Act that ‘if the event occurred in the context of a natural or other emergency, the President of the Republic of Zimbabwe, in consultation with the Authority and by notice in the Gazette, may exempt from the application of this Act a prescribed public entity operating in competitive markets or which is managed under a management contract by a third party.’

According to Fadzai Mahere, an opposition legislator, President Mnangagwa amended the Public Procurement and Disposal of Public Assets Act through SI 156 of 2023 “to give himself the power to exempt certain public transactions from the application of the Act” yet the law is meant to promote transparency in the tendering system.

President Mnangagwa also utilised his Presidential Powers to repeal the Sovereign Wealth Fund of Zimbabwe Act (Chapter 22:20) and replaced it with a new sovereign wealth fund known as the Mutapa Investment without consulting Parliament.

Mahere further noted that the amendment to the Zimbabwe Sovereign Wealth Fund Act to the Mutapa Investment “legalises” looting on a grand scale.

“The new Section 20A allows them to loot ‘without restriction’ and in USD. (The president) has usurped the law-making function of Parliament in breach of Section 134 of the Constitution,” said the Mt. Pleasant legislator.

Some of the key amendments relating to the powers and assets of the new Mutapa Investment Fund as stated in Section 11 say, the Board shall apply the Fund’s monies to the fulfillment of the Fund’s objects, Monies of the Fund not immediately required to fulfill the Fund’s objects may be invested in such a manner as the Board considers appropriate, and the shares held by the Government of Zimbabwe in the companies listed in the Fourth Schedule shall be invested in such a manner as the Board considers appropriate.

Some of the companies that are named in Fourth Schedule include Defold Mine (Private) Limited, Zimbabwe United Passenger Company Limited, Kuvimba Mining House (Private) Limited, Silo Investments (Private) Limited, National Oil Company of Zimbabwe (Private) Limited, Cold Storage Commission Limited, Petrotrade (Private) Limited, People’s Own Savings Bank (POSB), Netone Cellular (Private) Limited, National Railways Holding Zimbabwe, Tel-One Private Limited, Arda Seeds (Private) Limited, Zimbabwe Power Company (Private) Limited Powertel Communications (Private) Limited, Allied Timbers (Private) Limited, Telecel Zimbabwe (Private) Limited, Air Zimbabwe Private Limited, Industrial Development Corporation of Zimbabwe, Cottco Holdings Limited, AFC Limited, Hwange Colliery Company Limited, National Railways of Zimbabwe (Private) Limited.

The Mutapa Investment Fund further says no later than 21 days after the effective date of these regulations, the directors, corporate secretaries, or transfer secretaries, as applicable, of the companies listed in the Fourth Schedule shall — (a) make the necessary changes to the appropriate share registers to reflect that the Fund is the holder of the shares in question; and (b) deliver to the Chief Executive Officer the appropriate share certificates issued in the name of Mutapa Investment while the President may, for the sake of public transparency and after consulting the Board, alter the Fourth Schedule by adding, removing, or substituting any assets therein, or replace the Schedule entirely, by notice in a statutory instrument.

Section 12 of the Mutapa Investment Fund relating to Transfer of funds states that:

(1) With respect to investments made under this Act, the Fund may without restriction or delay in a freely convertible currency transfer the following funds into and out of Zimbabwe—

(a) contributions to capital, such as principal and additional funds to maintain, develop or increase its investment; and

b) proceeds, profits from the assets, dividends, royalties, patent fees, licence fees, technical assistance and management fees, shares and other current income resulting from any investment of the Fund under this Act; and

(c) proceeds from the sale or liquidation of the whole or part of an investment or property owned by the Fund; and

(d) payments made under a contract entered into by the Fund, including payments made pursuant to a loan agreement; and

e) earnings and other remuneration of foreign personnel legally employed in Zimbabwe by the Fund or in connection with an investment of the Fund.

(2) Any transfer of funds shall be allowed only after paying all tax obligations imposed on the amount to be transferred in accordance with the stipulated tax laws.

(3) Notwithstanding subsections (1) and (2), in the event of serious balance of payments or external financial difficulties, the Reserve Bank of Zimbabwe may temporarily restrict payments or transfers related to the Fund, provided that such restrictions are imposed on a non-discriminatory and good faith basis.