Lafarge volumes remain flat

Trade volumes for cement manufacturer, Lafarge Cement Zimbabwe Limited, have remained flat for a year owing to the shrinking of the construction sector, a recent report has shown.

In a statement accompanying abridged financial results for the year ended 31 December 2019, the company’s chairman, Kumbirayi Katsande, said the development was not that bad considering the performance of the economy.

“The business maintained its volumes flat on prior year at 323,000 tonnes,” said Katsande.

“This was commendable performance as growth in the construction sector declined by 14% according to the Reserve Bank of Zimbabwe.”

He said inflation-adjusted revenues for the company grew from ZWL 449 million in 2018 to ZWL 919 million in 2019, with the Individual Home Builder (IHB) category continuing to contribute significantly to the business’ top line.

“The business achieved improved margins as gross profit was ZWL 496 million in 2019 versus ZWL 141 million in 2018,” he explained.

“The improved margins realised were a result of focus on agile pricing and disciplined cost management across the business. Finance costs were ZWL 48 million compared to ZWL 7 million in 2018 and this was largely attributable to full-year interest costs on the US dollar-denominated group loan advanced to the business in 2018.”

Katsande said the business revalued its property, plant and equipment, adding the outcome of the valuation resulted in a net after tax revaluation gain of ZWL 310 million.

“Subsequently, full year comprehensive income was ZWL 488 million compared to ZWL 8 million in 2018,” he elaborated.

The business, Katsande said, did not have any new borrowings during the year under review.

Subsequent to 31 December 2019, the Reserve Bank of Zimbabwe issued confirmation that it had ring-fenced part of the group loan as legacy debt,” he said.

“The company is currently working with the Reserve Bank to issue a financial instrument to secure the legacy debt.”

Katsande said with the Zimbabwean economy not likely to improve any time soon, more policy reforms are needed to counter the dynamics prevailing around parallel market foreign currency trading.

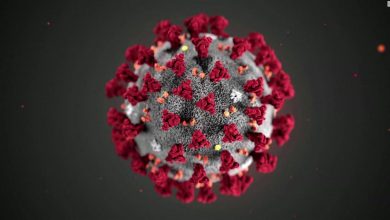

“The impact of the COVID-19 pandemic on the economy is yet to be fully quantified, but is projected to further influence the slowing down of economic activity,” said Katsande.“Demand will inevitably decline in response to the new fundamentals that come with the impact of COVID-19. However, new opportunities are likely to be present in the coming year as the economy continues to evolve. With a dynamic strategic agenda in place and the capital investment to support it, this should go a long way to mitigate the negative effects of a difficult economic environment.”