The Pensions Industry Report for the quarter ended March 31, 2024 has shown a notable rise in assets in the sector denominated in foreign currencies, as published by the Insurance and Pensions Commission (IPEC).

Foreign currency-denominated assets surged by 58 percent from US$257 million in the first quarter of 2023 to US$406.3 million in the first quarter of 2024, now accounting for 24 percent of total assets.

The report highlights key developments and supervisory activities consistent with IPEC’s statutory mandate to protect policyholders and pension scheme members in Zimbabwe.

The major asset classes within this category were investment property (41 percent), equities (31 percent), prescribed assets (10 percent), and money market investments (eight percent). This marks a shift from the previous year’s proportions of 47 percent, 30 percent, six percent and three percent respectively.

According to the report, the Victoria Falls Stock Exchange (VFEX) has played a pivotal role in diversifying and adding sustainable value to pension funds by enabling investment in foreign currency-denominated securities.

As of the reporting date, 13 counters were trading shares on VFEX. The report notes that holding foreign currency-denominated assets has been instrumental in cushioning the assets from inflationary erosion.

Despite the positive growth in assets, contribution arrears remain a pressing issue.

As of 31 March 2024, contribution arrears stood at US$28.9 million, constituting 7.1 percent of the industry’s foreign currency-denominated assets. This represents a staggering 237 percent increase from US$8.6 million in the previous quarter.

IPEC urged boards of funds and employers to address USD arrears, as they significantly impact the reasonable expectations of members.

Total forex income for the quarter amounted to US$49.52 million, a 161 percent increase from US$18.99 million in Q1 2023. Of this, US$46.33 million was realised income, constituting 94 percent of the total.

Total forex benefits expenditure was US$6.9 million, with administrative expenditure at US$4.1 million, bringing the total expenditure to US$11 million. Additionally, total forex contributions for the quarter stood at US$26 million.

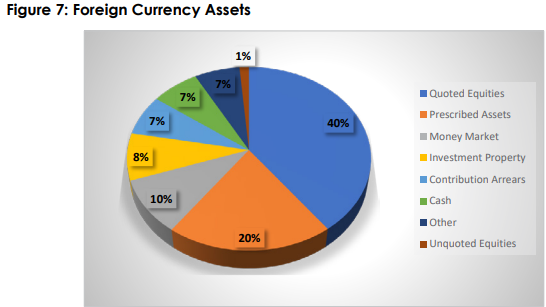

Foreign currency-denominated assets were primarily concentrated in equities, prescribed assets, money market investments, and investment property, collectively accounting for 78 percent of total forex assets.

Major investments included VFEX counters, the Eastern and Southern African Trade Fund (ESATF), Afrexim, Nedbank, Quilter Plc shares, and Anglo America.

IPEC emphasised the critical importance of timely remittance of contributions, urging boards of funds to establish clear guidelines and engage with sponsoring employers to make sure there is prompt and consistent remittance.

This is essential for safeguarding the interests of pension scheme members and ensuring the financial security of employees.

This report underscores the dynamic nature of the pensions industry in Zimbabwe and the ongoing efforts to manage and grow assets in a sustainable manner while addressing challenges such as contribution arrears and making sure there is fair allocation of income generated by foreign currency-denominated assets.