De-dollarisation still a challenge for Zimbabwe

De-dollarisation of the economy is still a challenge for Zimbabwe, four months since the country banned the use of foreign currency for all domestic transactions.

On June 24, the government banned with immediate effect the multicurrency system, which had been adopted in February 2009 following the collapse of the Zimbabwean Dollar as a result of hyperinflation.

Despite the ban, forex transactions still take place in both the formal and informal economy, owing to lack of confidence in the local currency, which depreciates almost on a daily basis.

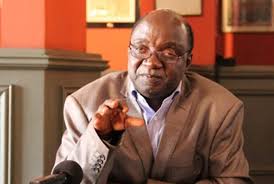

Addressing journalists in Bulawayo during a media engagement seminar on an alternative macroeconomic framework for Zimbabwe, an economist with the Labour and Economic Development Research Institute of Zimbabwe (LEDRIZ), Prosper Chitambara, said it would be difficult for the country to return to mono currency.

“The process of de-dollarisation is very difficult because once a country has dollarised it becomes difficult to go back to local currency,” said Chitambara.

“Like in Zimbabwe now, do you know that there are people who have been given permission to charge in US dollars? And that is a form of dollarisation. Even NGOs are allowed to give per diems in US Dollars, as well as embassies. That in itself is a form of dollarisation.”

He added: “The government has also announced to float a US Dollar-denominated savings bond. That’s also dollarisation. So we have not actually de-dollarised.”

Asked why the government was reluctant to adopt the South African rand instead of forcing de-dollarisation which is proving difficult to realise, Chitambara had this to say: “It is because of the issues of national sovereignty. It is more of political considerations because the rand is the optimal currency for Zimbabwe because South Africa is our biggest trading partner.”

Chitambara said while rand usage could come with some challenges it still made economic sense for Zimbabwe to adopt it.

“Of course the rand is not as stable and as strong as the US Dollar but it actually makes more trade and economic sense, not to even join (the Rand Union) but to use the rand as the medium of exchange because it makes it cheaper to trade with South Africa and it reduces foreign exchange risks,” he said.

“Even Professor Mthuli Ncube did a paper while he was still at the African Development Bank which actually showed that the rand was Zimbabwe’s optimal currency. What the government could do would be to say we are now paying our civil servants in rand as a way of enforcing the usage of the rand.

Civil servants are currently demanding salaries indexed to the US Dollar as the only way to realise value out of their incomes.