Former Finance Minister, Tendai Biti told Parliament that the Zimbabwean economy is not in a position to sustain its own currency and insisting on its use would lead the country to disaster.

The Zimbabwean Dollar (ZimDollar) was re-introduced last month in the form of Statutory Instrument 142 of 2019, where the government banned use of foreign currency ordering all transactions to be done in local fiat currency.

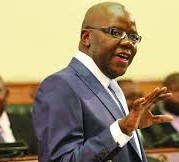

Making his submissions in Parliament Tuesday, Biti, MP for Harare East Constituency and one of the MDC vice presidents, still insists that the ZimDollar is not a viable option for the country, as most of the fundamentals required in the introduction of a currency did not exist.

“The attempt to de-dollarise the Zimbabwean economy is a disaster that will not work. It will not work because the fundamentals for the introduction of our own currency simply do not exist,” he exclaimed.

The former finance minister pointed out that the rising inflation and hyper inflationary environment was enough evidence to show that the ZimDollar was weak.

“In May 2019, before the introduction of SI 142/2019, our inflation was 96 percent. In June of 2019, after the introduction of SI 142/2019, our inflation had risen to 175 percent,” Biti said as he presented the mathematics.

“The ordinary person who shops in a supermarket will tell you that bread went up from ZW$1.20 to ZW$$7.20. So if you do the mathematics just on bread and Mazoe alone, our inflation in real terms is 700 percent. Even accepting figures from the Zimbabwe National Statistics Agency (ZimSTATS), one can see that the official definition of hyperinflation is where you have month on month inflation moving by a fact of 80 percent.”

Biti said Zimbabwe could only consider having its own currency if there was productivity in the economy as well as jobs.

“When you are not producing and when 95 percent of your people are in the informal sector selling vegetables, air time and tomatoes, you do not have an economy that can sustain the reintroduction of your currency,” he said.

He stated a need to balance exports and imports within the country, which could encourage having an economy to sustain the local currency.

“At the present moment our imports are around US$7.9 billion and our exports – that which we sell outside are around US$3 billion. So the ratio of our exports to imports is a ratio of 1:4. This means for every $1 that we are receiving in the form of export receipts, $4.00 are going out in the form of imports,” highlighted the former finance minister.

“So, when you have a deficit of 4:1 where your current account deficit is minus 15 percent of Gross Domestic Product, you do not have an economy to sustain the reintroduction of your own currency.”

Biti also pointed out citizens had no trust in the ZimDollar due to their past experiences with it as most people lost their savings.

“Pensioners lost their money because of the ZimDollar and the working people of Zimbabwe lost their savings because of the ZimDollar. So no one can ever trust the ZimDollar,” he said.

SI 142 of 2019 entails that the re-introduction of the ZimDollar is represented by the RTGS$ and will be the sole currency to be used for legal tender purposes in Zimbabwe.