Casual labour remains the dominant source of income for rural households with 40 percent of families reporting it as their primary means of livelihood last year and this year according to the 2024 Zimbabwe Livelihoods Assessment Committee (ZimLAC) Rural Livelihoods Assessment Report.

Casual labour refers to people who are employed on a temporary, rather than a permanent or regular basis and usually, these labourers work in sectors such as agriculture, construction, retail, and other service industries short term.

The ZimLAC survey collected data from a total of 18 001 households, with at least 300 households sampled per district, while primary data collection took place from May 4 to 20, 2024 while data analysis and report writing ran from May 27 to June 7, 2024.

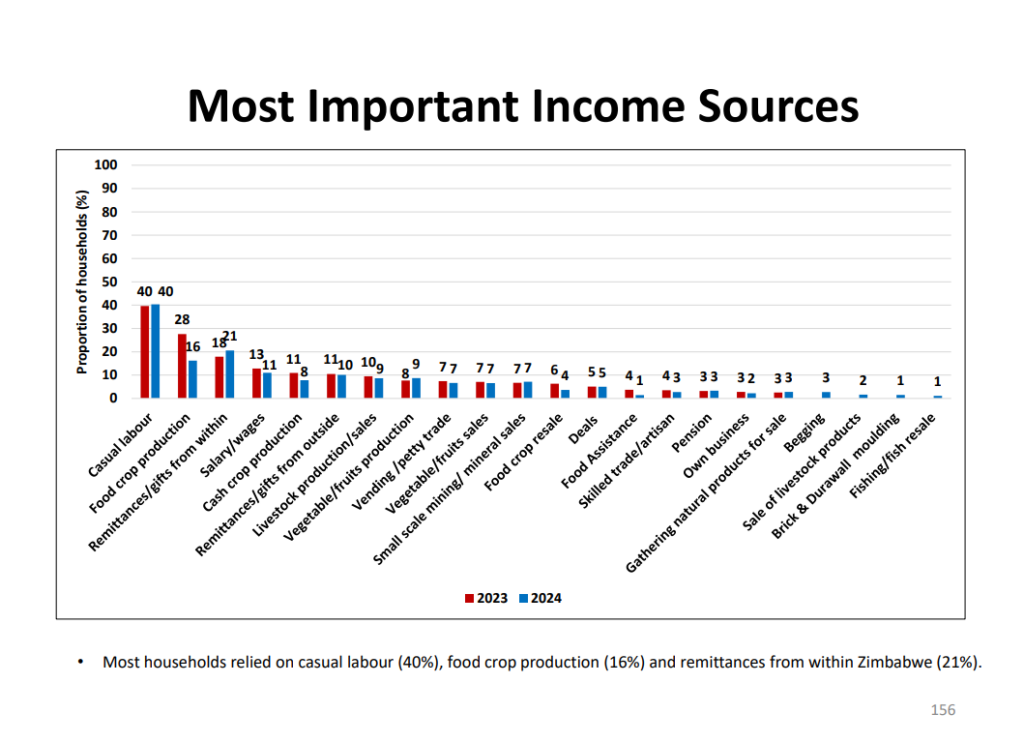

According to the report, food crop production is the second most significant income source for rural households, with 16 percent of households depending on it in 2023 jumping to 28 percent in 2024.

Remittances from within Zimbabwe also play a crucial role, contributing to the income of 21 percent of households in 2024, up from 18 percent in 2023, an increase that reflects the growing importance of domestic remittances in sustaining household livelihoods.

These findings are illustrated in a detailed chart showing the proportion of households relying on various income sources in 2023 and 2024.

An academic and commentator Bhekizulu Tshuma said it was not surprising that casual work was the top source of income for rural households because this type of labour is prevalent in economies with high levels of informal employment.

“This is a significant source of income for many households, especially in rural areas where labourers are often paid daily or weekly, depending on their arrangement with short term employers,” he said, adding that casual work was now a preferred model of work since the labourers were not entitled to allowances or benefits such as health, paid leave, or job security that is commonly provided to permanent employees.

“This is the type of work where one comes to your field, does the work and goes, or someone comes and paints your house for three days then goes after earning their money. You find it’s also easier for most employers.”

Tshuma explained that casual labour was where workers were hired on an as-needed basis rather than being employed on a permanent or long-term contract.

Other notable income sources include salaries or wages, which dropped from 13 percent in 2023 to 11 percent in 2024.

Cash crop production decreased from 11 percent in 2023 to eight percent in 2024.

Remittances or gifts from outside Zimbabwe slightly decreased from 11 percent to 10 percent in 2024.

However, nationally, diaspora remittances have emerged as Zimbabwe’s largest source of foreign currency, consistently surpassing foreign direct investment, portfolio investment and official development assistance since 2009, the then Reserve Bank of Zimbabwe (RBZ) Governor John Mangudya said last year in December after a meeting of the RBZ Monetary Policy Committee (MPC).

RBZ said diaspora remittances alone contributed 16 percent to the country’s total foreign currency inflows of US$9.44 billion as of October 31, 2023.

The ZimLAC report also stated that sales from livestock production slightly decreased to nine percent this year from 10 percent last year.

Vegetable or fruit production increased from eight percent in 2023 to 10 percent in 2024 while vending or petty trade remained stable at seven percent for both years.

The ZimLAC report also highlights smaller, yet significant, income sources such as small-scale mining or mineral sales (seven percent), food crop resale, six percent in 2023 dropping to four percent in 2024.

Engaging in deals as a household source accounted for five percent for both 2023 and 2024.

Notably, the proportion of households relying on food assistance dropped from four percent in 2023 to one percent in 2024, probably due to the hunger season caused by drought.

Skilled trade or artisan work, pensions, own businesses, gathering natural products for sale are less common but still vital income streams for certain households, each accounting for around three to four percent of household income sources.

Interestingly, the data indicates minimal reliance on activities such as begging accounting for only three percent, sale of livestock products, and fishing or fish resale, each constituting just one to two percent of household income sources.

Reacting to the other sources of income, Tshuma said overally, the ZimLAC report provides valuable insights into the “diverse and evolving” income strategies of rural households in Zimbabwe.

“However, as I said before, the significance of casual labour remains important, then we see agriculture, and remittances playing a role in maintaining household livelihoods,” said the academic.