The life assurance sector in Zimbabwe recorded a significant increase in insurance revenue for the nine months to September 2025, but faces structural challenges including a heavy reliance on funeral policies, high rates of policies not taken up, and persistent lapses, according to the latest report from the Insurance and Pensions Commission (IPEC).

The report, detailing the performance of the country’s 12 direct life assurers, shows the industry is dominated by a few key products and players, raising concerns about market concentration and consumer protection.

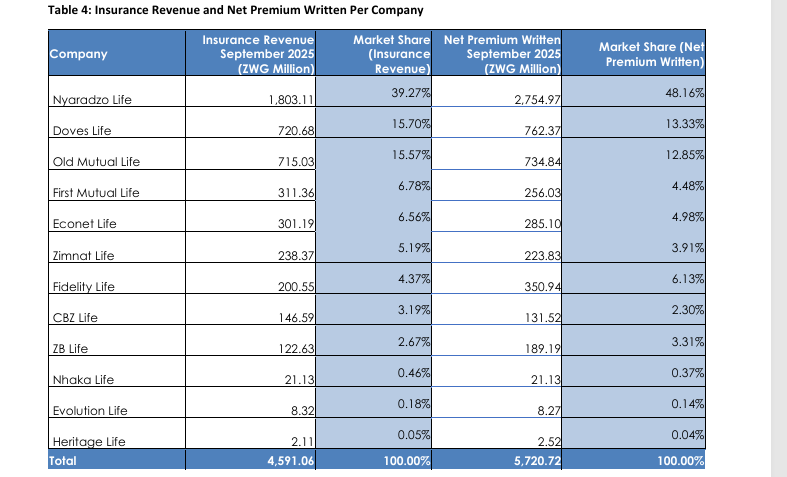

Direct life insurers generated total insurance revenue of ZWG4.59 billion, approximately US$172.05 million, a 39 percent increase from the US$123.77 million recorded in the same period in 2024.

However, this revenue is heavily concentrated.

Foreign currency-denominated revenue accounted for 55 percent of total insurance income, down seven percent from the previous period’s 62 percent, mainly due to exchange rate stability.

“Heritage Life and Nhaka Life failed to submit their mandatory foreign currency reports. The Commission urges industry players to submit all required reports on time to avoid regulatory sanctions.”

Funeral assurance and group life assurance continued to be the primary sources of income for the life insurance sector, together accounting for 82 percent of the total revenue.

The share of revenue generated from funeral assurance and group life assurance is steadily rising, affecting the market share of traditional life assurance products.

IPEC noted that a “notable trend in the life insurance industry is the shift from traditional long term products towards predominantly renewable annual policies.”

This change is especially clear in funeral assurance and group life assurance policies currently available. This practice raises regulatory concerns about its compliance with the Funeral Directive’s objectives, particularly regarding the level of policyholder protection,” read the report.

As a result, the industry is strongly encouraged to strictly follow the rules set out in the Funeral Directive.

“Nyaradzo Life Assurance Company holds the leading position in the life assurance sector with a 39.27 percent market share, largely driven by its predominant revenue from funeral assurance policies,” the report states.

The total revenue of the top five companies in the sector reached ZWG3.85 billion, equivalent to US$144.33 million. These top five companies collectively account for 84 percent of the sector’s total revenue, indicating a “moderately concentrated market.”

The sector’s product mix remains narrow, with traditional long-term products losing ground.

“Funeral assurance remains the main driver of the life assurance sector, representing 68.04 percent of total revenue. Group life assurance is the second-largest segment, making up 14.27 percent of total revenue,” the report notes.

This concentration raises regulatory concerns, with IPEC highlighting “a notable trend in the life insurance industry is the shift from traditional long-term products towards predominantly renewable annual policies.

“This change is especially clear in funeral assurance and group life assurance policies currently available. This practice raises regulatory concerns about its compliance with the Funeral Directive’s objectives, particularly regarding the level of policyholder protection.”

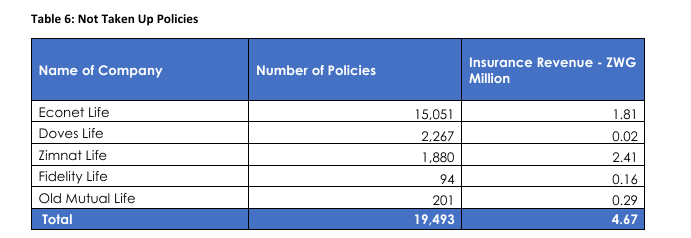

A significant concern for the regulator is the high number of policies that are sold but ultimately not activated by customers.

During the quarter, the sector reported 19,493 Not Taken Up (NTU) policies, leading to a loss of projected revenue of ZWG4.67 million.

The report singles out specific companies for scrutiny – Econet Life, Doves Life, and Zimnat Life, Fidelity Life and Old Mutual Life, which are strongly advised to promptly initiate an investigation into the underlying causes of their high NTU rates.

“This may include conducting surveys to identify specific issues such as affordability, poor product understanding, or dissatisfaction with the onboarding process.”

IPEC further warns that “life assurers are encouraged to closely monitor how agents present their products to potential clients to prevent misrepresentation.”

The sector also continues to struggle with policies lapsing after sale.

It started the third quarter with 2 122 824 active policies, of which 97 111 lapsed, resulting in a lapse ratio of 4.57 percent.

“Policy lapses are mainly attributed to affordability issues and changes in policyholders’ circumstances,” the report finds.

It urges insurers to maintain “proactive and effective communication with policyholders before lapses.”

One company, Nhaka Life, reported an alarmingly high lapse ratio of 27.59 percent.

“It is strongly recommended that Nhaka Life conduct detailed experience analyses to identify the main reasons for these elevated lapse rates,” IPEC advises, urging the company to “craft and execute targeted, data-driven strategies to lower lapse rates and enhance policyholder retention.”

The report concludes that the sector’s over-reliance on funeral assurance is unsustainable for long-term growth, calling for strategic innovation and diversification to rebuild public trust and ensure the industry’s future relevance.

Leave a comment