Ever-rising inflation left Finance and Economic Development Minister, Mthuli Ncube, with no option but to unveil a supplementary budget for 2022.

Presenting the 2022 Mid-term Budget review statement in Parliament Thursday afternoon, Ncube said fiscal developments during the first half of the year, characterised by increasing revenues and expenditure pressures, necessitated the revision of the approved 2022 National Budget.

“The revision is necessary to allow spending agencies to meet increasing costs of undertaking originally budgeted programmes and projects that will ensure the 2022 objectives are met,” he told legislators.

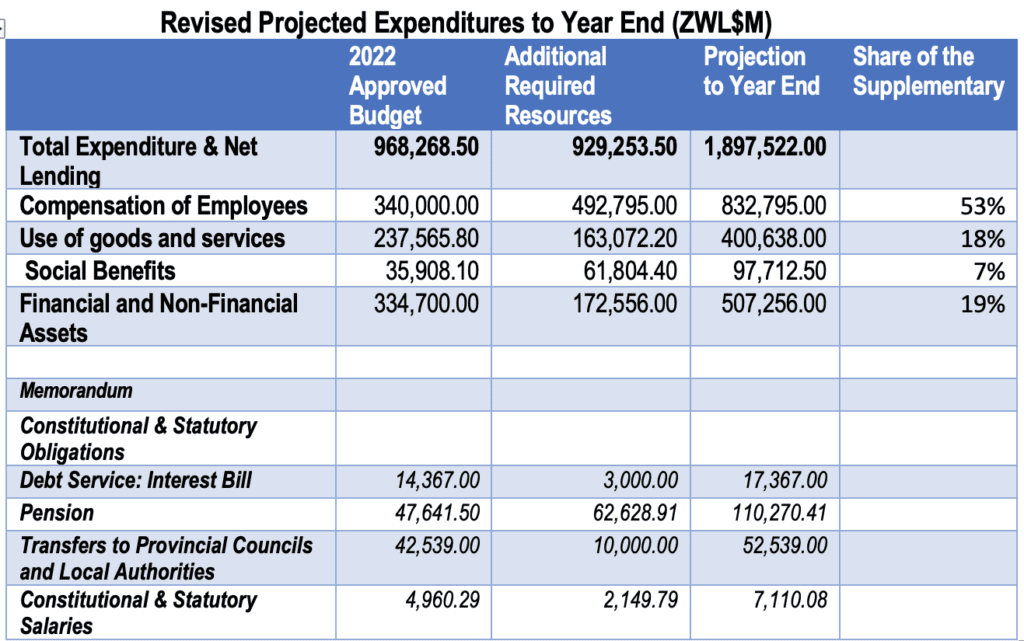

“Revenue collections to year-end are now projected at ZWL$1.7 trillion, while expenditures are now estimated at ZWL$1.9 trillion. This is against the approved Budget of ZWL$968.3 billion, entailing additional spending of ZWL$929 billion.”

The additional expenditures, Ncube said, will go towards the following areas:

The bulk of the supplementary budget (53%), Ncube said would go towards employment costs to cushion public servants against the increasing cost of living.

“The balance of the additional resources are going towards meeting government consumables (18%), capital projects (19%), and social benefits (7%),” he explained.

“Government remains committed to addressing the welfare of civil servants in a fiscally sustainable manner. The challenges of yesteryear where the wage bill crowded out other development expenditures should be avoided in order to create the right conditions for sustainable economic growth that will provide scope for payment of decent salaries to our hard-working workers.”

Meanwhile, Ncube reviewed the Pay As You Earn (PAYE) tax-free threshold on local currency remuneration from ZWL$300,000 to ZWL$600,000 per annum while adjusting the tax bands to end at ZWL$12 million from the current ZWL$6,000,000 per annum, above which tax is levied at a rate of 40 percent, with effect from 1 August 2022.

“This measure is envisaged to increase disposable income, spur consumption spending and income for corporates,” he said.

“I also propose to review the local currency tax-free bonus threshold from ZWL$100,000 to ZWL$500,000 with effect from 1 November 2022.”