Zimbabweans are set to face increased taxes on various goods and services in 2024 as the government seeks to boost revenue.

Finance Minister Mthuli Ncube presented the proposed 2024 national budget of Z$58.2 trillion to Parliament on Thursday, outlining a range of tax measures aimed at addressing the country’s economic challenges.

Ncube proposed raising the tax-free threshold for civil servants to Z$750,000 per month or Z$9,000,000 per annum. This measure aims to provide some relief to low-income earners amidst rising inflation and economic hardship.

“I, further, propose to review the local currency tax-free bonus threshold from Z$500,000 to Z$7 500 000, with effect from 1 November 2023,” said Ncube.

The finance minister also proposed to “convert the current COVID and Cushioning allowances, aggregating to US$300, to be part of the pensionable emoluments across the board, effective January 2024”.

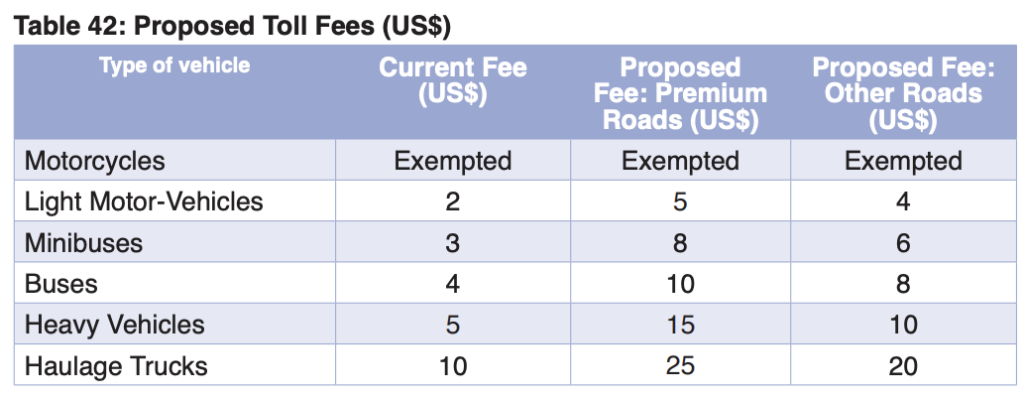

Motorists will pay more in road taxes after the finance minister proposed a hike in toll fees.

Toll fees are currently pegged between US$2 and US$10, depending on the type of vehicle.

I, therefore, propose an upward review of Toll Fees on premium roads, that is, Harare-Beitbridge and Plumtree-Mutare and other roads as follows, with effect from 1 January 2024,” said Ncube.

Passport seekers will also bear the brunt of the tax hikes, as the finance minister proposed increasing passport and selected fees charged by the Central Vehicle Registry.

“Additional revenue generated from the above measures will be ring-fenced towards road infrastructure development,” the finance minister said.

Currently, an ordinary passport costs US$120 and an emergency passport costs US$220.

As of January, an ordinary passport will cost US$200 and an emergency passport will cost US$300.

To discourage the consumption of sugary beverages, the finance minister proposed introducing a levy of US$0.02 per gram of sugar contained in beverages, excluding water. The levy will come into effect on January 1, 2024, and the revenue generated will be dedicated to cancer therapy and the procurement of cancer diagnosis equipment.

In a significant move, the finance minister introduced a Wealth Tax levied at a rate of 1% on the market value of residential properties with a minimum value of US$100,000. This tax aims to address wealth inequality and will come into effect on January 1, 2024. However, principal private residential properties owned by elderly persons above 70 years will be exempt from the tax.